S.R. Wood & Son Ltd: How commercial property landlords can help reduce their void periods.

How commercial property landlords can help reduce their void periods

by Jacob Wood. S.R.Wood & Son Ltd

Introduction:

Keeping the void period as short as possible is quite obviously of high priority to most commercial property landlords. After all, an empty investment property that is not income producing defeats the purpose of having one. Moreover, should a commercial property remain vacant for more than 3 months, the empty property business rates relief will come to an end, meaning the landlord will have to account for business rates as an additional expenditure. There are exceptions to this of course, for example where a property is Listed, has a Rateable Value

below £2,900 or has charitable ownership.

So how can commercial property landlords help to mitigate long void periods?

Condition:

As the old adage goes “first impressions count”. The condition of a commercial property during its leasehold marketing, both internal and external can play a pivotal role in how long it remains on the market for. It’s not the only factor and good condition cannot be considered a silver bullet solution, but it certainly helps. Whilst there are a myriad of factors which might impact the length of time a property remains on the market before occupation (market influences, location, size, value and amenity just to name a few), landlords can help reduce the void period by ensuring the property in question presents well. The theory that better condition properties typically experience shorter void periods can be substantiated by recently undertaken research by S.R. Wood & Son.

The Research:

To focus the research, the data has been taken from leasehold transactions undertaken by S.R. Wood & Son between 2021 and 2023 (to date). By narrowing the data to this timeframe, the research remains mindful of the impact which time has on the property market, such as supply and demand changes and most importantly, value. Furthermore, the data focuses solely on retail letting transactions in Luton, Dunstable and surrounding environs. This is to remain mindful of varying demand levels for different property sectors and indeed the different market

trends from different localities.

Data Analysis:

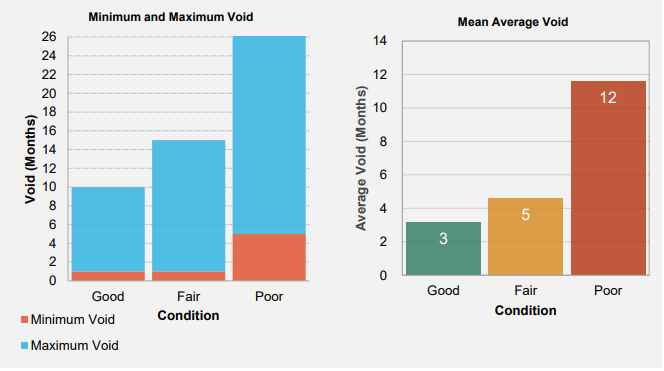

As can be seen from the graphs, there is a distinct correlation between the condition of a property and the length of time it remains vacant. To be clear, the data captured refers to the period of time until each property was placed under offer and not until the lease had completed. This is because certain transactions undergo more protracted legal proceedings than others. When rounded to the nearest whole month, properties which were in a good condition had a mean average void period of 3 months. Properties in fair condition mean averaged 5 months and properties in a poor condition were vacant for four times longer than the good condition ones, mean averaging 12 months void.

Conclusion:

Brief as it is, this research conducted by S.R. Wood & Son has shown clear indications that property condition has an impact on void period during the leasehold marketing process. The reasons for this have not been delved into but are likely to do with the upfront expenditure a tenant would incur in refurbishing a property in poorer state of repair. It is true that rental incentives are often provided to tenants where a property’s condition is sub-par, but the evidence is clear that better condition properties tend to rent faster than those which require work.

As mentioned in the ‘Condition’ section of this report, property owners must be mindful that condition is not the sole factor which might impact the length of time their property remains vacant for. Current take-up for office accommodation for example is low due to poor demand and no matter how well an office might present, this does not improve its open market demand… although should an office requirement present itself, better to have a grade-a office than a dilapidated one!

One might also question what sort of tenant is to be attracted if a property is in a poor state of repair. Properties in better condition may attract stronger tenant covenants than those which are in a poorer condition. This however is another topic.

To conclude, avoid the void and remember, first impressions count.

You can see all the commercial property listed by S.R.Wood & Son Ltd on NovaLoca here.

[…] S.R. Wood & Son Ltd: How commercial property landlords can help reduce their void periods. Link. […]