Knight Frank – How inflationary pressures are heightening the need to upgrade logistics networks and facilities.

For current Knight Frank listings on NovaLoca click here.

How inflationary pressures are heightening the need to upgrade logistics networks and facilities.

scott-webb-BB0mMC8y0Pc-unsplash

Rising costs mean operators must look to improve efficiencies to maintain profit margins. This will drive demand for more greener, fuel efficient fleet and facilities. It is likely that operators will increasingly be looking at optimising location, increasing automation, better utilisation of warehousing space or reducing the length and complexity of their supply chains; holding more stock closer to the consumer to reduce supply chain risks and minimise freight costs.

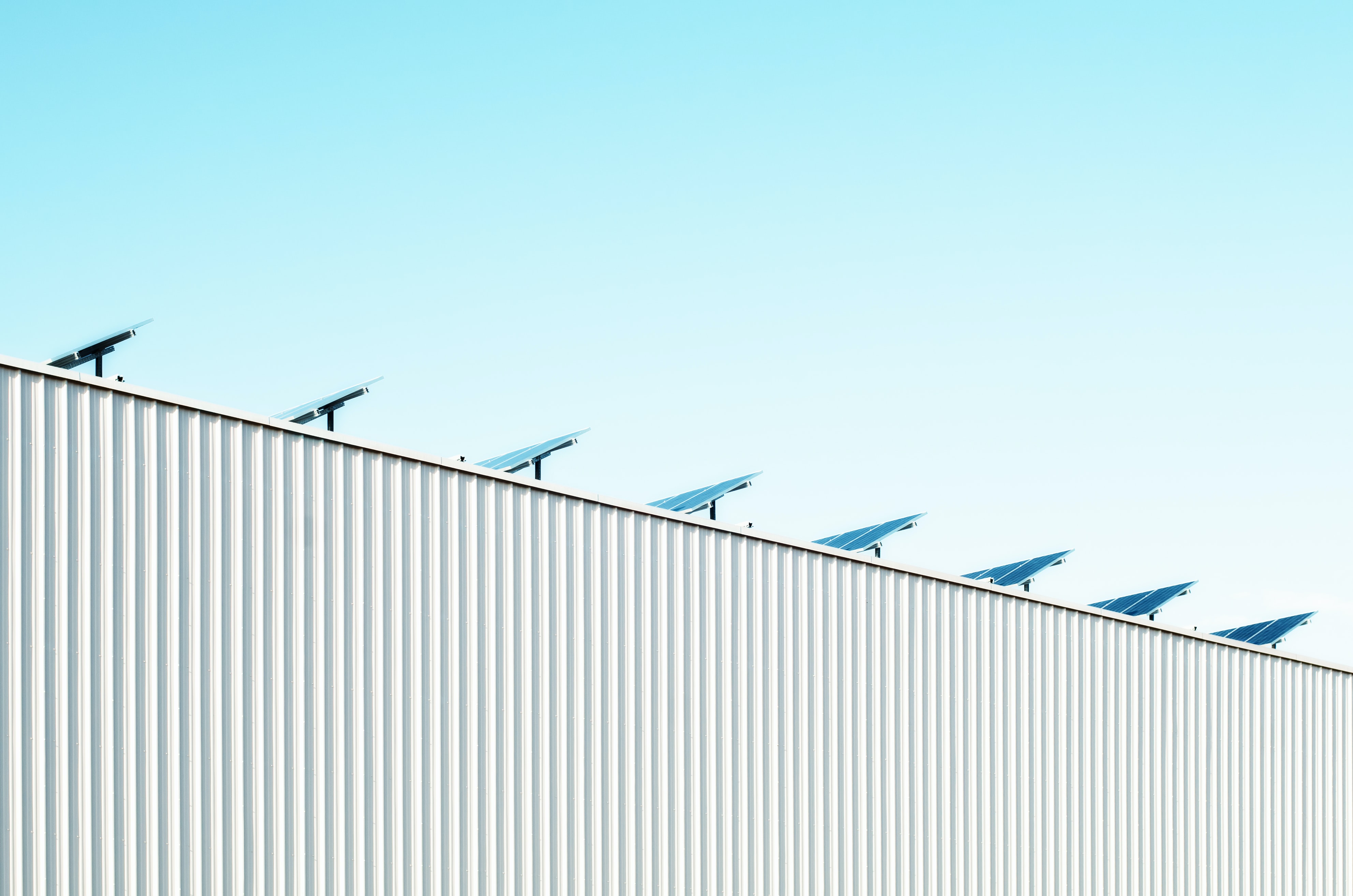

Oxford Economics is forecasting gas prices in Europe to double this year, increasing by 103%. Natural gas is important for electricity generation and higher gas prices will be reflected in higher electricity costs. Rising energy bills are adding to operators’ costs, and tenants in less efficient facilities face having their margins dented most. This may prompt greater interest in green energy and onsite power generation and storage as a way to reduce reliance on grid power and the impact of price shocks.

Rising fuel prices and disrupted supply chains have pushed up the cost of transportation and shipping. Some operators will be looking to hold greater stock volumes in order to protect their order books, which will require greater storage capacity. Other operators will look to improve their fleet operations, with greener, more fuel-efficient transport modes or vehicles.

Operators need to improve energy performance and sustainability, optimising their facilities and distribution networks is now more crucial than ever and this will mean continued demand for well located, high quality facilities. Sustainability features and energy performance will become increasingly important to occupiers.

What about slowing e-commerce growth?

Some operators have recently announced a pause in their network expansion plans as slowing e-commerce growth coupled with rising geopolitical uncertainty, heightened market volatility and inflationary pressures lead to a shift in business strategies. However, Amazon’s recent report of slowing growth has been misinterpreted by many as a contraction.

The “race for space” we have witnessed for warehousing over the past couple of years will ease as the e-commerce market matures, though the sector remains in expansionary mode.

The pandemic accelerated the growth of online retail and drove retailers and distribution firms to acquire space and rapidly expand their footprint and capacity, to capture a share of the growing market. E-commerce will continue to be a key driver of occupier demand for warehousing space and many firms have committed to space that is not yet built, demonstrating their plans for further growth over the longer term.

Logistics operators will continue to drive take up of warehouse space, with demand being driven mainly by a need for strategic improvements and upgrades to distribution networks and facilities, rather than a rapid upscaling of operations.

Diverse tenant base

The strength of the occupier market is underpinned by an increasingly diverse mix of occupiers seeking space. Warehouse space is being sought after by less traditional operators such as film studios, data centres, advanced manufacturing.

The rise in advanced manufacturers taking space is being driven by a variety of industries, where advancements in technology, coupled with a diminishing cost advantage for offshore manufacturing (due to rising shipping and overseas labour costs), as well as a desire for greater sustainability and a need for supply chain resilience, are enabling and encouraging a reshoring of component manufacturing. Over the past four quarters (to Q1 2022), manufacturers accounted for 15% of take up across London and the South East (units over 50,000 sq ft), up from 8% in the previous four quarters (to Q1 2021).

Film studios have also been active in taking warehousing space in London. In 2021, Netflix took units at Segro Park in Enfield, North London and Warner Bros. took space in Leavesden, north of Watford. A lack of purpose-built facilities, coupled with rising demand for content is driving studios to consider warehouses to be used as a blank canvas in which to house stages and production facilities.

Tight supply and rising rents are driving development

Vacancy rates and availability of space are at an all-time low. This lack of existing stock, coupled with strong rental growth is prompting an increase in development activity, and we expect a robust uptick in development completions over the next six months.

Across London and the South East (including East England), the volume of speculative development has almost doubled over the past year. At the end of Q1 2022, there were 53 speculative schemes (units over 50,000 sq ft) under construction and available, totalling around 9.2 million sq ft. Gateway 14, Suffolk located within the Freeport East region accounts for a significant proportion of this space. Situated on the A14, the location provides access to the ports at Ipswich and Felixstowe and the Freeport status means firms can import and export goods outside of normal tax and customs rules.

Rising uncertainty around construction materials pricing, along with the prospect of further interest rate hikes, which will drive up the cost of financing development, are likely to curtail speculative development activity. Rising construction costs for warehouses mean developers will face tighter profit margins and thus their appetite to develop space speculatively and take on additional risk of a void period will decline over the coming months and some speculative schemes scheduled to start later this year may be put on pause until a tenant is secured. This will keep supply relatively tight.

Increasing environmental standards and energy costs, coupled with higher redevelopment/retrofitting costs and a rising supply of new facilities, raises the risk of obsolescence and of stranding some older assets that have fallen behind in terms of environmental / energy performance. Rising energy costs will lower the appeal of older, less efficient facilities and landlords and occupiers will need to be mindful of this when taking on these assets.

To read Knight Franks latest report on the Logistics & Industrial market in London and the South East, click here.

Or explore our reports on markets across the UK regions here.

For more information, or if you have any questions please contact:

Gus Haslam, Partner, Logistics & Industrial Agency – London & South East

+44(0) 207 861 5299

Claire Williams, Logistics & Industrial Research Lead

claire.williams@knightfrank.com

+44(0) 203 897 0036

Charles Binks, Head of Logistics & Industrial Agency

+44(0) 207 861 1146