M25 office market set for a strong year

The M25 office market is back on track, says Knight Frank, with take-up in the second quarter a “healthy” 623,000 sq ft, 17% above the five-year quarterly average.

Emma Goodford, head of National Offices at Knight Frank, says the robust activity of the first half of 2013 “is a clear indication that occupier confidence has improved, reflecting better news on the economy”. She says the firm is tracking 850,000 sq ft of deals that are under offer and feels confident that the market is getting back on track, saying “2013 is set to be the strongest year since 2008.”

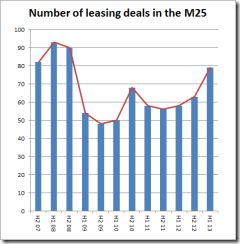

After a strong first quarter, take-up for the first half of 2013 in the M25 area is now 1.3m sq ft, which Knight Frank says is the strongest for the first half of any year since H1 2008. There were 79 office deals in the region during January-June this year, which the firm says is the most of any half-year period since H2 2008.

The most significant jump in activity was in the M3 corridor, which Knight Frank says has been arguably the most badly affected submarket since the downturn. Take-up in the M3 corridor was 304,000 sq ft during the second quarter, which is 61% above the five-year quarterly average. Activity in the M4 corridor was more subdued, after a resilient 2012, with Q2 take-up in line with the five-year quarterly average at 373,047 sq ft.

Knight Frank says the overall take-up for the second quarter was all the more impressive given the absence of any of the “supersize” deals that have characterised activity in most quarters during recent years.

Among the most active locations in Q2 was office space in Reading, which accounted for almost half of M4 take-up and was also the site for the largest deal in the quarter – the acquisition by Reading Council of 85,000 sq ft at Plaza West.

There were two pre-lets in Q2 – one before construction and one during – with the Pension Protection Fund leasing 39,396 sq ft at Abstract’s Renaissance in Croydon and Henkel pre-letting 35,890 sq ft in Hemel Hempstead.

The biggest challenge to occupiers by mid-2014 will be a lack of choice, Emma Goodford says, with new and Grade A availability set to fall to below 5% of vacancy in the M25 area overall. Rents are expected to rise as a result in the key markets to the West of London, in the Thames Valley and the prime Surrey towns.